Achieve Financial Freedom

Through Property Management

- Australia Wide Properties

- High Capital Growth

- Positive Cash Flow

Akhlinder Dani

Property Investment Advisor

Akhlinder Dani offers Independent Advisory Services that are not just accredited but endorsed by ASPIRE Property Advisor Network. With qualifications from Property Investment Professionals of Australia (PIPA) and membership in the exclusive Qualified Property Investment Advisor (QPIA®) group at Equimax, Akhlinder is the leading authority in property investment nationwide.

Akhlinder Dani is more than just a Property Investment Advisor; he’s a dedicated advocate for your financial success. With over two decades of experience and a deep understanding of Melbourne’s dynamic real estate market, Akhlinder and his team is your compass in the world of property investment.

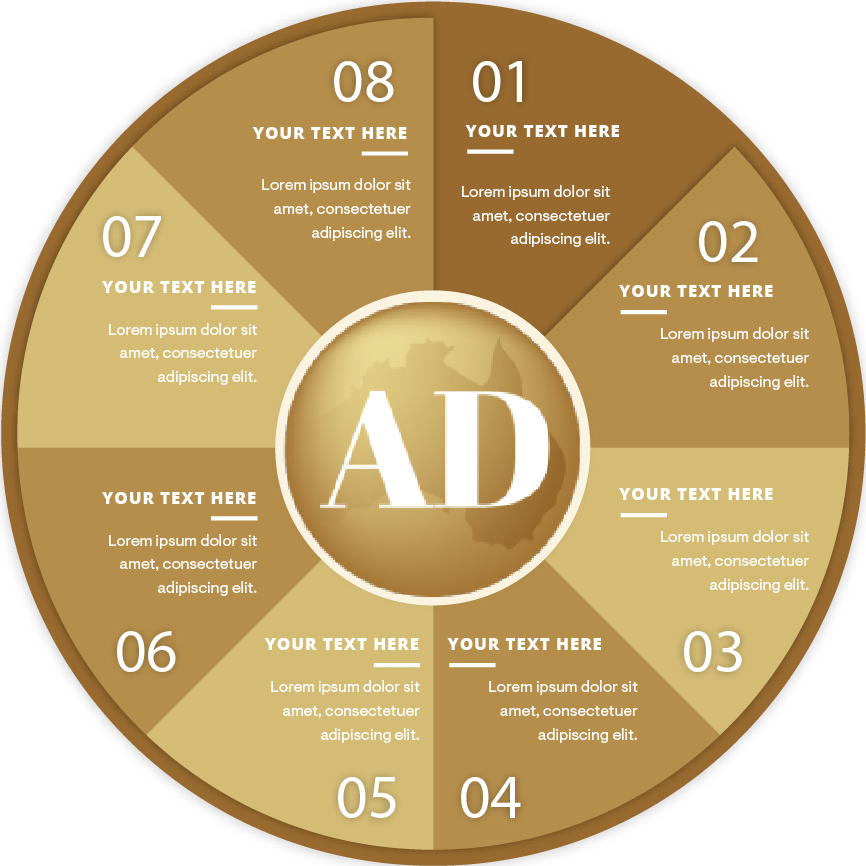

Our Investment Process

Our property investment advisors follow a step-by-step process to

identify suitable properties and strategies for clients.

Discovery

Research markets, trends, assets

Strategy

Define goals, risk, potential options

Shortlist

Target qualifying locations, properties

Decide

Select strategy, preferred investments

Property Success Navigator

Opening Box of Wealth through Property Investment Mastery

Market Analysis

In-depth insights into Australia’s property market trends.

Investment Strategies

Customised plans for long-term wealth creation and positive cashflow.

Only engaged by clients

No conflict of interest, unbiased decisonsn based on research and data

What Our Clients Say

Hear what some of our satisfied clients have to say

about working with our property investment advisors:

Grow Your Wealth with Strategic Property Investments

At Akhlinder Dani Property Investments, we believe transparent communication and accurate reporting are essential to building trust with our clients. The first step is evaluating different location types – capital cities, outer suburbs or regional areas – to see where demand and rental yields are strongest. Once ideal locations are shortlisted, study property types. Consider middle-ring suburbs with family homes, industrial lands near transport hubs or CBD apartments near business districts. Due diligence is critical when selecting individual properties. Check rental histories, strata records if units, valuation assessments, nearby amenities and infrastructure plans. Model cash flows accounting for capital gains, expenses and taxes to assess potential returns.With a strategic long-term approach focused on quality assets in up-and-coming areas, property can deliver stable income and capital growth surpassing many other investments. Contact us to tap into our expertise and start growing your wealth today.

Why Choose Us?

Akhlinder Dani is one of the best property investment advisors in Australia Dedicated to helping our clients maximise returns from their investment properties. We take a holistic approach to evaluate each client’s individual needs and circumstances to recommend tailored investment strategies. Whether you’re looking to invest in residential, commercial or mixed-use assets, our team has the expertise to conduct comprehensive due diligence on assets and deal structures. As a capital property advisor in Melbourne, our clients receive personalised and dedicated service with direct access to our director. Let our expertise work for you.

Property Investment Advisor Strategies

Akhlinder Dani understands that every client’s needs and objectives are different. That’s why we take the time to truly understand your financial situation and investment goals. Through in-depth consultations, we’ll assess factors like your risk tolerance, investment timeline and target returns. Then we develop a tailored strategy utilising the right asset types, locations and structures. Whether you want regular rental income, long term capital growth or a combination, we have strategies to match. Your unique plan considers both current and future market cycles to put you in the strongest position to achieve your property goals.

Achieve Financial Freedom Through Property Investment

Serving the whole of Australia

AD property investment advisory team is here to guide you every step of the way. With over two decades of experience, Akhlinder specialises in helping individuals and businesses achieve their financial goals through strategic property investments.

Investing in real estate can be a lucrative endeavour, but it requires knowledge, strategy, and expert guidance. Akhlinder offers tailored solutions to help you make informed decisions and maximise your returns in Australia’s dynamic property market.