The Australian property market is gaining momentum once again as more investors enter the scene with the help of property investment advisors in Australia. This comeback has been seen after activity slowed during the pandemic period. Now, various categories of buyers recognize the enduring importance of real estate within an investment portfolio. Several factors underpin this renewed interest from property investors. While risks always exist within the market, experienced property Investment consultants guide clients in navigating current challenges. Overall, investors play a valuable role in housing stability and opportunities across Australia.

Importance of Investors in the Market

Property investors considerably impact the residential and commercial real estate sectors. When investment levels are high, it brings price consistency, providing confidence for homeowners and those looking to purchase. Investor demand supports overall market liquidity as well.

This increased liquidity occurs because property investors purchase investment properties as long-term holdings. However, some turnover still exists within portfolios, which helps maintain transaction velocity. Higher liquidity creates stable property cycles that avoid damaging price booms and slumps.

Investors’ role in improving market depth and depth is a crucial reason their renewed activity bodes well. It signals broader optimism and aids the functioning of the market. Better-functioning markets are more secure environments that attract more involvement from various players. With investors involved, housing remains an integral part of the economy.

Reasons for the Comeback

Several specific factors are driving the resurgence in interest from property investors:

- Low-interest rates – Borrowing money is currently very affordable for investing, potentially unlocking strong returns through high leverage. This loose financial environment remains appealing.

- Low inflation – With price rises contained, investment returns from housing look preferable to other options like term deposits. Inflation risk also stays quiet.

- Economic recovery – Some investors see opportunities emerging in property sub-sectors or locations most impacted by the pandemic downturn as activity bounces back.

- Government stimulus – Large-scale fiscal support programs boosted overall wealth and confidence within the economy, filtering through to housing demand.

- Relaxed lending – New policies make it easier for newer players like first-time investors and those re-joining with financing to enter the market.

- Tax incentives – Measures like tax breaks for new residential construction are attracting rebuilding and development activity.

Current Market Analysis

The current signs show investors have renewed belief in the housing market:

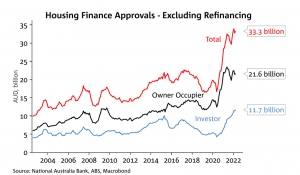

Approvals for housing finance

More owners and investors are getting loans to buy property. It shows demand is picking up after slowing in past years. Loan data gives clues about future sales activity. A study by the National Australian Bank shows that property owners receive 27.58 billion in housing approval, including owner-occupied and investor approvals.

Average loan sizes

| Average new loan size | Monthly change | Year-on-year change | |

| National | $608,448 | -0.3% | 1.1% |

| NSW | $754,832 | -1.0% | 0.3% |

| VIC | $602,471 | -1.0% | -2.6% |

| QLD | $557,510 – record high | 1.7% | 4.7% |

| SA | $510,057 – record high | 0.6% | 6.4% |

| WA | $497,275 – record high | 0.2% | 3.9% |

| Tas | $444,726 | -2.7% | -3.1% |

| NT | $429,333 | -1.3% | -2.5% |

| ACT | $598,643 | -0.6% | -6.0% |

The amounts borrowed for purchases reached document stages in NSW, Victoria and Queensland recently. It implies growing budgets investors bring or rising costs. It additionally hints the ones markets have electricity in spite of macro demanding situations like hobby modifications.

Experts like property investment advisors in Melbourne examine such traits. They recognize neighborhood conditions and forecasts. Investors can access their insights to spot promising locations. For example, a consultant can also identify local areas cashing in on life-style shifts or infrastructure initiatives. Their steerage allows fit investment dreams and strategies to modern real possibilities.

Types of Investors Showing Renewed Interest

Several categories of property investors appear to be leading this renewed activity:

- Self-managed superannuation funds – Seeking to benefit from favourable superannuation rules, these funds are increasingly using real estate to boost retirement balances.

- Young professionals – As confidence builds, more individuals and young families are adding an investment property to their portfolio alongside their primary residence.

- Overseas buyers – Some past offshore investors are returning to the market now that international borders are opening up after COVID-19 travel bans.

- High-net-worth individuals – Even non-traditional property players with significant wealth from other assets and sources are trying real estate deals.

- Smaller investors – Technological advancements are smoothing access for those with less capital through online platforms and more accessible financing.

Challenges and Risks

Of course, obstacles still exist that investors must navigate:

- Price affordability – In specific high-demand neighbourhoods, escalating values could impact cash flow yields for purchases made at peaks.

- Rental market tightness – Low vacancy rates in cities like Sydney and Melbourne may pose occupancy and income risks if macro factors change tenant demand.

- Economic uncertainty – Lingering effects from the pandemic, like new variants, introduce ambiguity despite hopes for recovery.

- Construction delays – For off-the-plan purchases, unforeseen changes elongating project timelines carry financial obligations.

- Stamp duty costs – The transfer tax eats significantly into short-term profits if properties must be sold quickly.

- Interest rate volatility – Loose monetary policy may persist, potentially pressuring affordability and portfolio debt servicing.

- Leverage management – Using maximum permitted lending rather than sustainable debt levels ups investment risk profiles in a downturn.

Invest With Top Property Investing Consultants in Australia

Renewed activity and interest from Australian property investors are bullish signs highlighting ongoing belief in real estate as a stable, long-term wealth creator. Structural drivers like population increases, economic development, and urbanization will continue supporting solid fundamentals.

While risks remain, experienced Property Investment consultants in Australia emphasize the importance of prudent portfolio construction, diligent market research, and sensible financial structuring tailored to individual circumstances. Their guidance carefully considers macroeconomic conditions to mitigate volatility.

This resurgence implies confidence that Australia’s major housing markets and the small, well-positioned locales stand to deliver sound investment outcomes in the years ahead. As stability returns further post-pandemic, investors rightly take advantage of the opportunities within the recovering industry. Real estate investment will keep playing an important role nationwide.